Autumn Budget in a nutshell

29 October 2021

Autumn Budget 2021

The greatly anticipated Autumn budget was bought to the table by Chancellor Rishi Sunak on Wednesday but how might it affect you, your business and your family? Read on for our brief guide to the main points raised in the Autumn 2021 Budget:

• Inflation will rise to approximately 4% in 2022 which is up by 0.9%

• Universal Credit taper rate cut from 63p to 55p, plus a £500 increase in the Work Allowance – to be put in place by 1st December 2021

• A reminder that National Insurance Contributions (NI) will increase by 1.25% from 6th April 2022 - this is to fund the NHS and social care

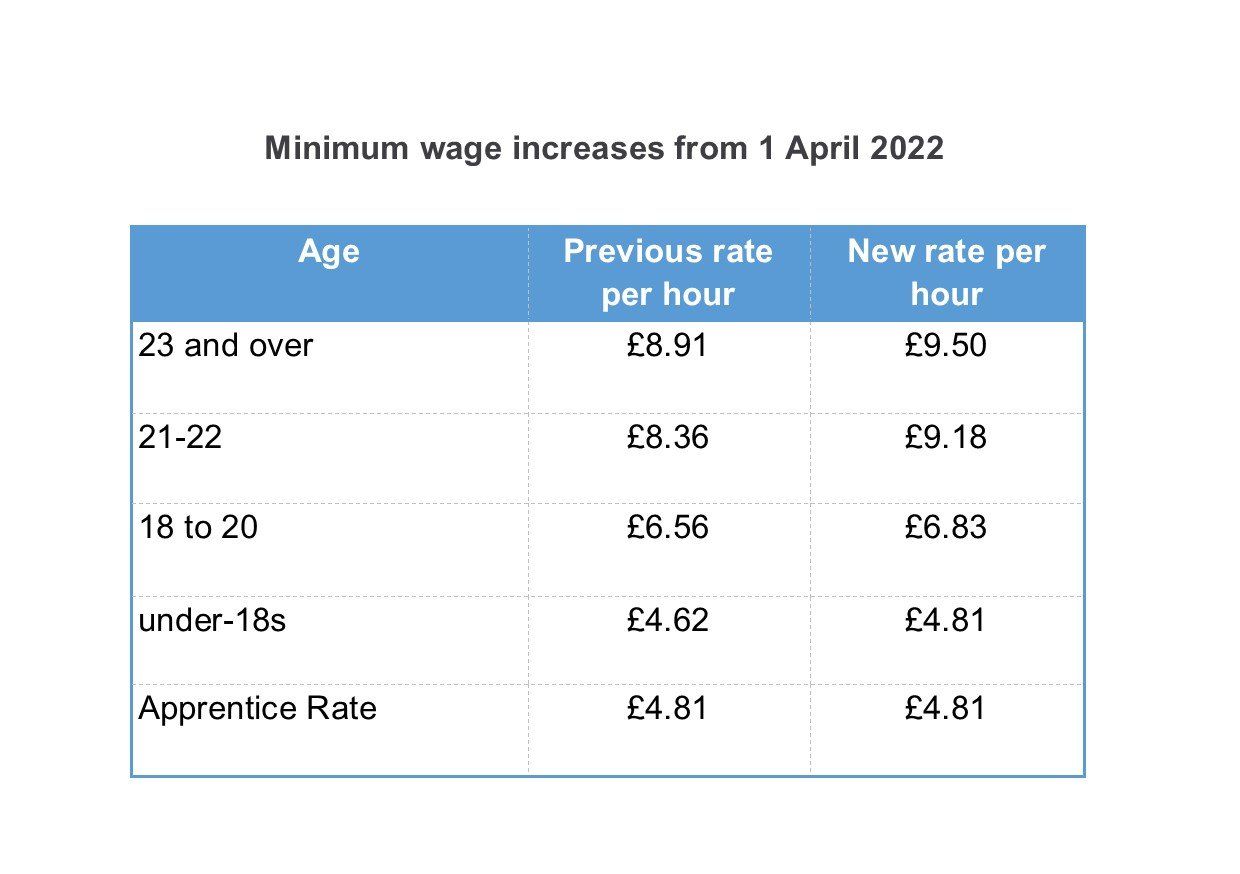

• National Living Wage set to increase next April to £9.50 an hour for those aged 23 and over (see table below for other rates)

• The fuel duty freeze remains

• A pay rise for public sector staff in April 2022

• The recovery loan scheme has been extended to June 2022

• 0% Savings rate band to remain at £5,000

• Adult and junior ISA limits to remain the same at £20,000 and £9,000

• Tax bands to remain frozen at April 2021 levels for 5 years

• Business rates multiplier has been frozen at 49.9p and 51.2p from 1st April 2022 until March 2023

• Personal tax threshold limits frozen until 2026

• 25% Corporation Tax rise from April 2023

• A 50% business rate discount for businesses in the retail, hospitality and leisure industries with a cap at £110,000

• Introduction of a 100% business rates relief for 12 months for firms to carry out improvements to premises from 1st April 2023

• Capital gains tax deadline for reporting and paying capital gains tax will increase from 30 to 60 days following completion

• A massive Alcohol costs shake up where higher strength drinks to have higher duties but lower strength drinks to be cheaper. The cost of a pint will also be cut by 3p

• Smoking costs to increase on both cigarettes and hand-rolling tobacco

• A levy on property developers of high-rise flats to pay for removal of dangerous cladding has been granted

• Libraries to be revamped and put back into action with new levelling up funds

• Extra funding will be provided for projects to support new parents

• A new programme called Multiply will be introduced to improve numeracy skills in adults

• Funding for school pupils will be put back to previous levels seen in 2010

• Internal domestic flights will have air passenger duty cut making it cheaper to fly within the UK

• Income tax applicable to dividends to increase by 1.25% from 6th April 2022

• Penalties for late submission and late payment of tax for Income Tax Self-Assessment come into effect from 6th April 2024 for those required to submit through MTD (all other taxpayers will be 6th April 2025)

• Residential Property Developers Tax (RPDT) will be charged at 4% on profit in excess of £25 mil